"Paytm To Bank Account"

"Paytm To Bank Account" ?

If you have not even received Paytm to Bank account Money Send yet. So you have a better place, here's the information about how to send money to your bank account with Paytm Wallet.

"Paytm To Bank Account" Money Transfer Service:

Since the launch of Paytm Payment Bank , Paytm has become complicated for a little bit of users. User wants to use paytm as a wallet only. for example…- Send money / send in a paytm wallet from one paytm wallet.

- Shopping from Paytm, Movies ticket book etc.

Before knowing about Paytm To Bank Account Money , we all understand what the KYC and account verification mean.

Must Read - How do I add money to ATMs?

What is KYC?

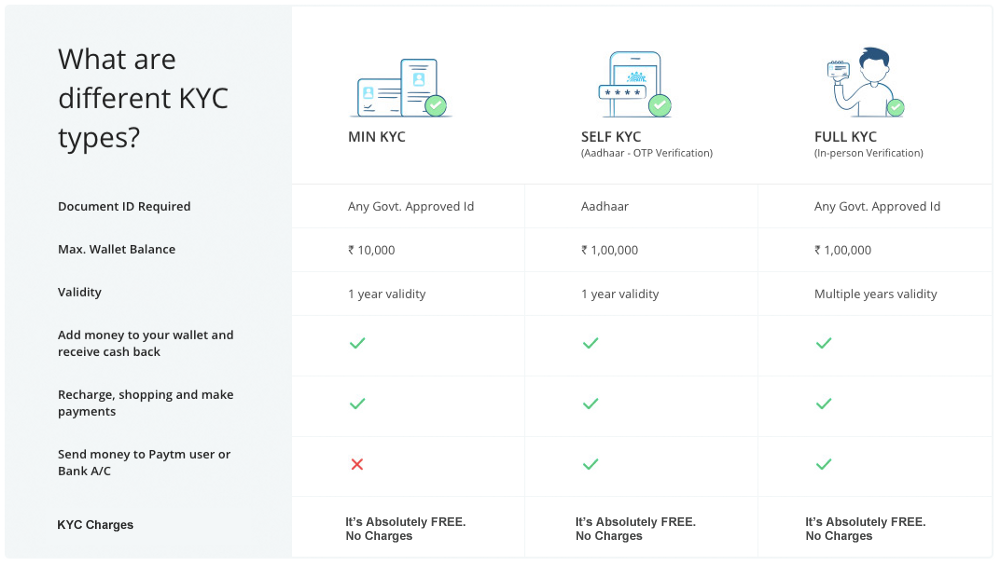

KYC Full Form is "Know Your Customer" and it is a process of verifying customers connected to a service. According to the Guideline of RBI (RBI), whatever customers use Bank or Wallet and need to transfer money to them. Then it is necessary to verify the KYC.RBI has set KYC 3 level for all Wallet and UPI services along with "KYC For Paytm ". Which is as follows.

Level # 1: If the most Minimum requirement level is. In this we can complete the KYC process by using any government document and keep the balance of maximum of Rs 10, 000 in the Wallet for one year. But we can not even transfer money on anything.

Level # 2: This is the middle level of KYC verification, in which we can complete the KYC Process by verifying OTP from Aadhaar Card and keep a maximum of Rs 100,000 in your Wallet with one year validity. Along with this, you can send or receive money in Bank or Wallet when needed.

Level # 3: This is a complete KYC verification, this process is completed with Agent verification and we can use all the Wallet or Bank services. Whether to get money or to send money to a bank or wallet.

Paytm To Bank Account Money Transfer: Step by Step-

Money is not available on the official website of Paytm Wallet from the bank. In this case, if you have to send money from Paytm. So your phone should have its App download.# 1: First we have to do a Paytm account, then we have to click on the passbook option given on the Home option.

# 2: After clicking on the passbook option, the available balance is displayed in our account and 2 links appear below.

- Send Money to bank account

- Add money to wallet

# 3: After clicking on Send money to bank account, we will see a button for the transfer in front of us. We have to click on that button.

# 4: Now we need to enter the details of Bank Account, in which bank we want to send money. Such as Amount (How much Money Send), Account Number, IFSC Code ( IFSC Code What Is ?), Account Holder name. After that, you can send money by clicking Send Button.

- If you are a normal customer. You have to pay 2% Charge to send money to the bank account.

- If you are a Marchent, then this service is completely free for you. You do not need to pay any charges for this.

- 2nd level KYC verified customers Monthly can send 20,000 rupees and full verified customers can 25,000.

- We can send at least 100 rupees to the Bank from Paytm. Amount we can not send in the bank account less than this.

- In a transaction we can send 5000 rupees.

- New paytm customers will have to wait at least 3 days to use the Money Transfer feature. Only Paytm Wallet can bank Account money can send .

- If we do In person KYC Verification, then we can use Aadhaar Card or any Government Identity Proof for this.

No comments:

Post a Comment